Title loans online require a standing for"bleeding the poor." The name creditor does not chase after folks to utilize for loans, nevertheless it will provide quick access to emergency cash to folks who have their own car. The genuine fact in the issue is being low-income is not a viable component in who needs a loan. There are many different income levels that end up strapping women and men. It's not the dollar amount so far as the management of said income. A significant determining factor beforehand eligibility does not have anything related to earnings, but instead or not you own a vehicle.

For Starters, since a title loan is a short-term loan, those who need emergency cash to get an unexpected cost: medical, auto, funeral or home costs are usually reasons to obtain financing. When any of these costs go past a few hundred dollars, many people of all income levels may not have sufficient money in the lender to support the bill. Credit cards are often used to cover these kinds of emergencies, nevertheless in the event the available balance comes up short, a person might need to tackle the financial collapse in another manner. Car title loans tend to be a quick fix for those needing fast cash.

Credit ratings do not play favors to individuals with higher incomes. If a person is not able to deal with their earnings economically and ends up making payment errors or omissions, acquiring financial aid could wind up being a tricky undertaking. Banks and credit unions will not look favorably towards decreased fico ratings. Title loans will not look at your credit because their loan will be procured in the pink slip of your car or truck. As reassuring as this aspect could be to someone in a crisis scenario, the applicant must recall that the short-term loan might need to get paid in 30 days. Since the loan is secured from the car, it gets the payoff a top priority within the budget. For everyone that have terrible credit as a consequence of current financial issues, you are going to want to seriously consider this loan will be repaid in accordance with the loan conditions and requirements.

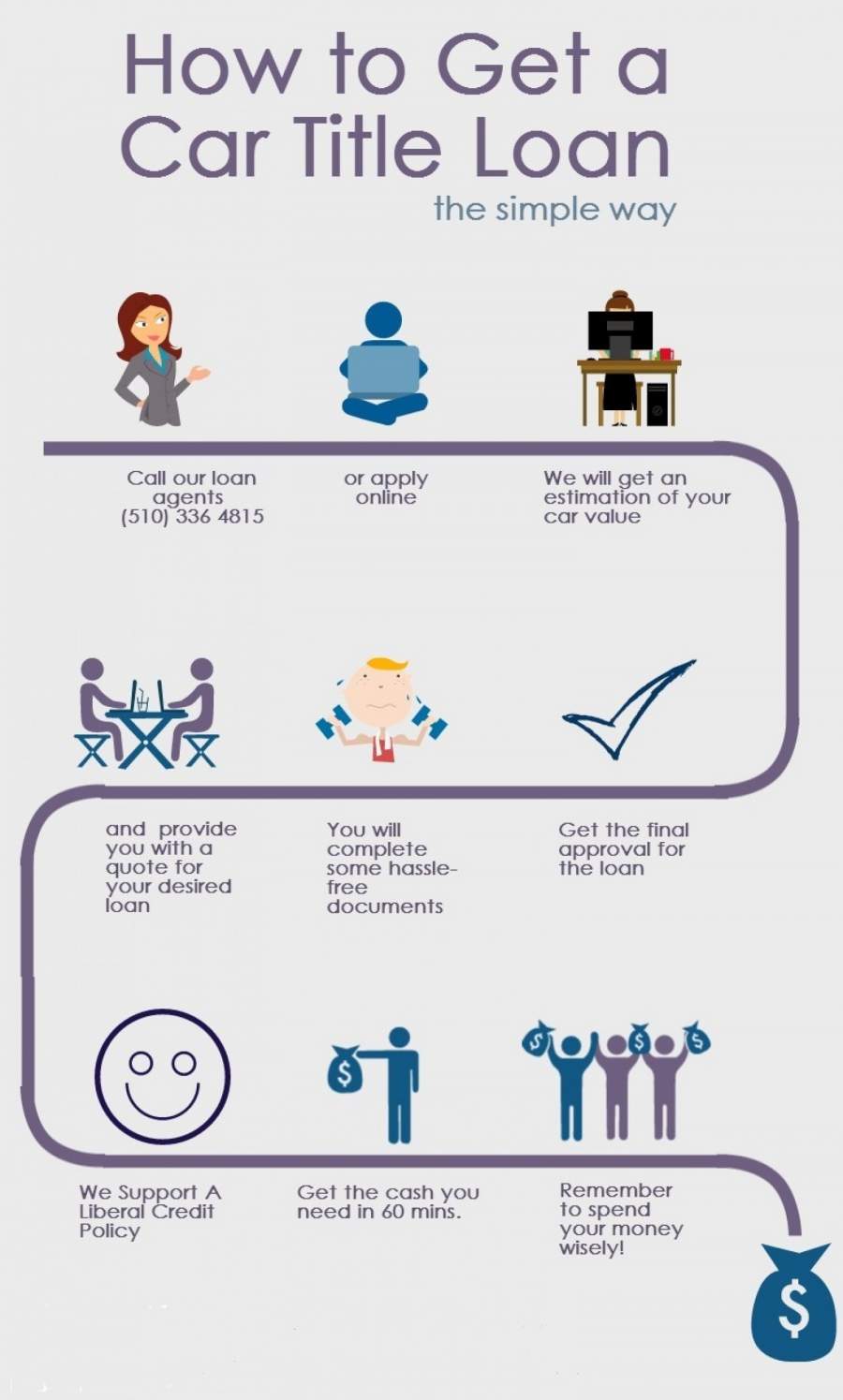

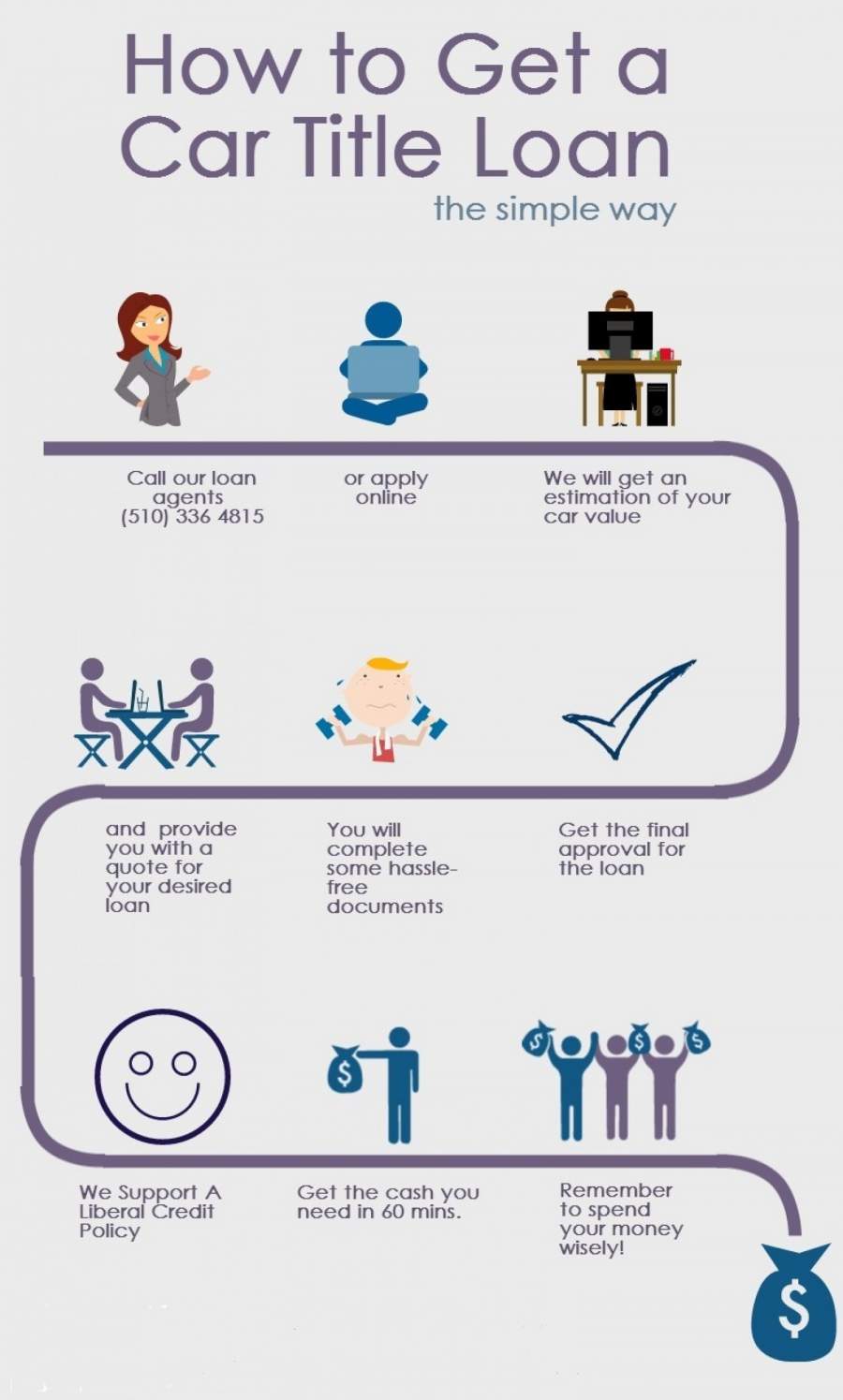

Some automobile title loan applicants just require quick access To cash. Some businesses Provide pay cycles of one pay per month or bimonthly. Some crisis expenditures my meltdown when paychecks will also be far Off to help. It is Wonderful to have an alternative for fast money during those times. A car title loan processes loans in as little as an hour. Where Else could someone get a few million dollar loan precisely the same day not Head in the specific same hour? The app is simple with lots of Businesses Offering online versions for 1 measure before the game. In Reality, There are online auto title loan companies claiming people at the comfort Of their own homes. Find a name creditor when emergency money is necessary today.

Finding A way from automobile title loans could be confusing for all. Automobile and auto title loans are given out to clients without a intensive applications. They are easily able to be attainable for individuals who utilize since the lender uses the client's car or car as collateral. There are no credit ratings which means individuals trying to borrow which have bad, no credit whatsoever have precisely the specific same odds of acquiring a loan using a car title lender only like with the other sort of loan.

The Issue For most women and men who choose to take these short-term loans is that they're predicted to invest back quickly. That could be easier said than done for most debtors. Auto title loans range from $500-$5000 based on exactly how much a person's automobile is worth. Bank's normally yield anywhere from 1-3 weeks to the loan to be paid back. This may result in a problem with debt for quite a few people when they cannot pay it off in time. How do you find the right debt solution whenever you are faced with this type of situation?

*Consolidation- Take a consolidation loan which can Permit you to settle your car title loan and have the decision to combine your balance alongside other debt you may have. You will prevent high interest rates and penalties billed by automobile title loan lenders and possibly decrease your monthly payment at a job to get your debt paid off. Advances don't work for everyone, but being that you must get approved the moment you employ. If your credit score doesn't let, this may not be a choice for you. You could also be charged a monthly fee on a consolidation loan and as it is unsecured, and also the intertest speed may be exceedingly large.

*Credit Counseling- In this Kind of situation the credit counseling company will study your financial plan and earnings and help you subtract your duties in order to pay your debt off faster. They will work with your lenders to set a payment agreement. It's not a guarantee your vehicle title loan lender will work and collaborate along with the counselor, nevertheless. Taking care of your debt this way might assist you later on having a goal to pay off your bills but won't help your credit rating. Creditors will still report that you are making payments drunk.

*Debt Settlement- You or a Professional negotiator might approach your lender and offer a payoff amount that's lower than what you owe. Most financial experts say to start off by supplying 25 percent of everything you actually owe and exercising. Debt settlement can help you save a wonderful deal of money but unless you have got the money to pay for, this may not be a choice for you.

*Bankruptcy- This is presumed to be a last resort and is something which has to be avoided if at all possible. You may lower your credit history as well as the BK stays on your credit report for seven years. It will get the automobile title loan collector of your backbone but may create difficulties for you as far as having future purchasing power.

Finding a means to paying off your debt using a Auto title loan may be a snowball process. Maybe the very best street to take Is working with your lender right to find a payment system that is right for you and your budget. Make sure you talk with your lender About your inability to create your payments or you might risk having Your automobile repossessed.

© Copyright Title loans in california

Make a free website with Yola